May 21st, 2020

Canadian Private Lender Market During the Global Crisis of 2020

Nearly every industry and market in the world is reeling from the current global crisis. We wanted to check on the private lending community in Canada to see how everyone is conducting business in today’s world, with social distancing protocols in place and so many people losing their income.

Thank you to all the lenders who shared their experience and provided this valuable information. We are very happy to say that for the vast majority (over 90% of respondents) it’s business as usual, with certain adjustments imposed by the current situation.

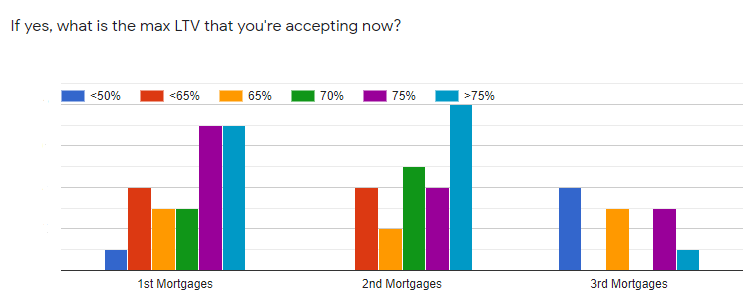

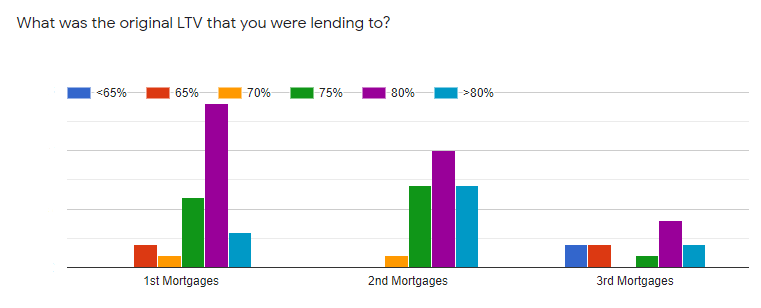

LTVs showing a positive outlook

It’s evident that most private lenders continue to operate on the same principles as before the crisis, depending on whether they have been more conservative or more aggressive in their lending style. The charts below show that many of the lenders even kept the LTV’s generally on the same level. Those skewing to a more conservative side have slightly lowered the percentages.

The process adjustment

With the overall positive sentiment, measures still need to be implemented. Among the crisis-related adjustments, in addition to lower LTV for some, many lenders report stricter due diligence on income and assessment of the current or potential effect the crisis might have on the borrower’s paying ability. For additional protection, some lenders also report charging interest upfront and working only with repeat borrowers for the time being.

Routine daily processes were affected as well. Abiding by the social distancing rules, we are all working from home, relying on technology and cloud storage more than ever before. Naturally, this also means appraisals had to be done differently.

Currently, drive-by appraisals are the most popular option. A close second is having the appraiser take photos of the property outside, while the borrower takes photos or videos inside. In some cases, it happens at the same moment, with the appraiser directing the process from the outside. In other cases, the borrower simply provides the most current interior photos. These also include video walkthroughs with the borrower inside the property.

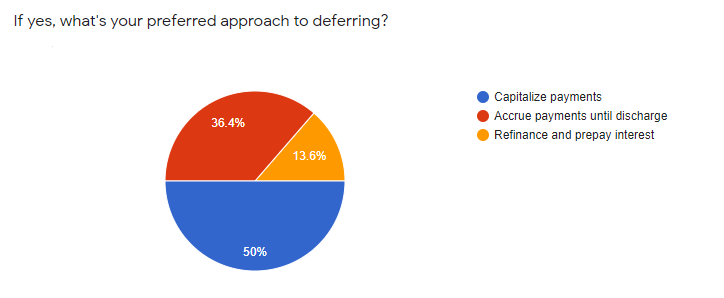

Handling payment deferrals

As the crisis hit unexpectedly, deferral requests were inevitable. The majority of lenders polled (over 80%) received those requests and approved them. Capitalizing payments seems to be the most popular approach to deferrals, with payment accrual until discharge coming as the close second.

The future looks promising

On a global scale, the current situation continues to change and evolve daily. Economies are still shut down and the consequences are yet to be fully comprehended. On the other hand, crises often prove to be rather lucrative for private lenders, so there’s every reason to maintain a positive outlook.

In Canada, the private lending market is exercising necessary caution to adjust to the new way of running the business and is charging full speed ahead, for the most part. The borrowers are likely to come across great investment opportunities in the present real estate market, and it’s up to the lenders to make the right decisions, turning the crisis into an advantage.